The innovation of the Payment Facilitator (PayFac) model

The latest chapter in the history of payment processing / merchant services.

You may have noticed in my last post about the payments ecosystem that I pointed to PayPal, Square, and Stripe as examples of Payment Gateways — admittedly, this was a bit of an over-simplification. While companies like Square do provide Gateways to enable online credit card acceptance, they play a far more important role as payment facilitators, or PayFacs. And you can’t have a discussion about the current state of the payments industry without discussing PayFacs.

So what are PayFacs?

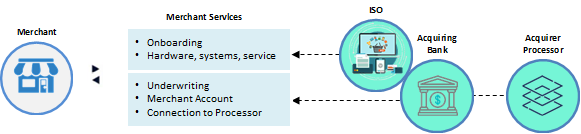

Similar to Acquiring Banks and ISOs (independent sales organizations), PayFacs provide merchants with everything they need to accept credit card payments — otherwise known as “Merchant Services.” While PayFacs cannot replace the role of an Acquiring Bank, they address a clear need in the market, with a business model that uniquely caters to merchants and, at the same time, delivers scale to the Acquiring Banks. To help explain, here’s a brief history of merchant services.

1950–1990: The early era of credit cards / merchant services

Following the creation of credit cards in the 1950’s and the introduction of POS terminals in the 1980’s, Acquiring Banks alone were responsible for finding merchants, selling them on the idea of accepting credit cards, reviewing and underwriting their credit applications, then onboarding them with the necessary hardware, systems, and processes.

In this early era of merchant services, Acquiring Banks such as Chase Merchant Services, Bank of America Merchant Services, and Wells Fargo (among others) were the single points of contact for merchants — they acquired these merchants then owned the relationship.

1990’s: ISOs enter the market to help Acquiring Banks achieve scale

Historically, the merchant account application process was cumbersome and time-consuming. This catered to larger businesses, which had the staff/resources to manage the application process, as well as the requisite financial history and documentation. However, by the 1990’s, as more SMBs sought to accept credit cards, banks were suddenly challenged to keep up with the growing interest from SMBs. As a result, ISOs stepped in as an outsourced sales function for the Acquiring Banks — they are a reseller, serving as an extension of the Acquiring Bank. ISOs increasingly acquired new merchants and became the primary point of contact for ongoing service and other needs.

However, the Acquiring Banks were still deeply involved. They continued to provision the merchant accounts and therefore continued to manage the credit underwriting process for each new merchant.

Late 1990's–2010: Gateways emerge to propel online commerce

A couple of key dates in the birth of e-commerce: Amazon was founded in 1994 and eBay a year later in 1995. Some lesser known dates: Authorize.net was founded in 1994, CyberSource and DataCash in 1996, and Bibit in 1997.

Authorize.net, CyberSource, DataCash, and Bibit were some of the original payment gateways in the market that enabled merchants to take their businesses to the internet. These gateways were independent, not affiliated with any ISO or Acquiring Bank (at the time), and merchants could either sign one up directly or find one supported by their Acquiring Bank.

Having said that, because the payment gateways were independent, merchants established a separate relationship with the gateway provider. The unfortunate consequence: merchant services had become fragmented as merchants now depended on multiple points of contact / multiple commercial relationships to access all of their merchant services needs.

2010–Present: PayFacs streamline merchant services

Two of the most notable PayFacs, Square and Stripe, were founded in 2009. Within the next two years, the first official PayFac programs were launched by MasterCard and Visa in 2010 and 2011, respectively.

So what makes the PayFac so special?

- The new “merchant”: The PayFac builds a relationship with an Acquiring Bank to become an approved merchant — the PayFac receives a Merchant ID from the card networks.

- Acquiring sub-merchants: The PayFac then acquires customers — the PayFac is the “master merchant” and its customers are the PayFac’s “sub-merchants.” Unlike in the ISO model, where the ISO resells merchant services as an extension / on behalf of the Acquiring Bank, the PayFac sits distinctly between the Acquiring Bank and the sub-merchant.

- Underwriting: Because the PayFac has the merchant relationship with the Acquiring Bank, the PayFac is responsible for underwriting its sub-merchants (as well as Know Your Customer, Anti-Money Laundering, and other compliance checks). The sub-merchants therefore avoid the traditional bank underwriting process and are instead able to become an approved sub-merchant in a matter of hours/days, not weeks/months.

- Portfolio diversification: The PayFac arguably undertakes some additional credit risk as it signs on sub-merchants that are smaller and in much less time. However, the PayFac aggregates at scale and therefore mitigates the additional credit risk through diversification.

- Funds flow: As the master merchant, the PayFac receives funds from the Acquiring Bank during the settlement process. The PayFac then redistributes funds to its sub-merchants, and handles any future refunds or chargebacks.

- Technology: PayFacs offer proprietary technology solutions — in the form of gateways, hardware, and/or other software — to their sub-merchants. For example, Square has its integrated POS system, Stripe offers its code and APIs, and Toast provides a suite of restaurant management software. By also providing these technology components, PayFacs are able to offer a complete merchant services solution.

Conclusion: The PayFac model significantly simplified the delivery of merchant services to its sub-merchants by:

- Utilizing sub-merchant aggregation to streamline the credit application, underwriting, and onboarding process.

- Re-uniting merchant services under a single point of contact for the merchant.

For now, it seems that PayFacs have carved out an enviable niche for themselves. Their growth (which has been substantial in recent years) is mutually beneficial to the legacy players of the payments ecosystem as greater and greater payment volumes feed more and more revenue to the Acquiring Banks, the Acquirer Processors, and the Card Networks — more on payment system economics in a future post. And though some ISOs find themselves at a disadvantage, others are finding ways evolve from resellers to becoming PayFacs of their own.

Thanks for reading. Please share or follow me for my next post.

Disclaimer: The views expressed here do not necessarily reflect those of my employer.